Given the rapid growth of e-commerce’s during the Covid-19 pandemic, much of it at the expense of retail store visits, there was some skepticism and debate around whether or not new revenue records would be broken during the “Cyber 5” holiday shopping days, which run from Black Friday through to Giving Tuesday. Well, the initial returns are in and records were still broken despite the Pandemic’s impact on the seasonality of e-commerce spending. Here are the key stats and the sources that the Accorin team believes are the most important so far. And look out 2021; it’s going to be another crazy growth year for e-commerce no matter when we all get vaccinated.

First, From ABC News:

- Black Friday hit a new total sales (online and retail) record with consumers spending $9b- an increase of 21.6% year over year

- On the retail side, in-store and curbside pickup increased 52% on Black Friday

- Large retailers saw 403% increase in sales the past two days over the October daily average – physical store visits were way up compared to earlier in the pandemic.

SOURCE: https://abcnews.go.com/Business/black-friday-hits-record-report/story?id=74435965

Digital Commerce 360 Provided some other interesting details:

- There were digital traffic jams with all of this activity: “50 major e-commerce sites experienced major delays or outages on the BF/CM weekend”

- U.S. shoppers spent a record $34.36 billion on retail websites over the five-day period from Thanksgiving to Cyber Monday, up from $28.49 billion for the same period last year.

- Digital revenue missed projections as more shoppers heeded retailer warnings to shop earlier to avoid out-of-stock items or shipping delays and took advantage of pre-Thanksgiving discounts.

SOURCE: https://www.digitalcommerce360.com/article/online-holiday-sales/

Shopify

- On November 27 Shopify tweeted: “Shopify merchants currently fluctuating between $1.5-3.5M in sales per minute (16K+ orders per minute).”

- Congratulations to Shopify. They’ve made watching e-commerce activity monitoring a true spectator sport with their datastories.shopify.com live experience over the Cyber 5 weekend. If you missed it check the Shopify Developers twitter account

- They had this cool, 3D live data stream indicating locations of orders and volume in real time. Around the world.

- Global sales set records (Shopify Tweet, Dec 3):

- Most importantly Shopify is touting that their merchants were up 76% over the 2019 holiday. An important distinction here is that Shopify looks at the “season” which began November 12 – much earlier than Black Friday.

For more great details and stats from Shopify, go here.

Retailware (Twitter)

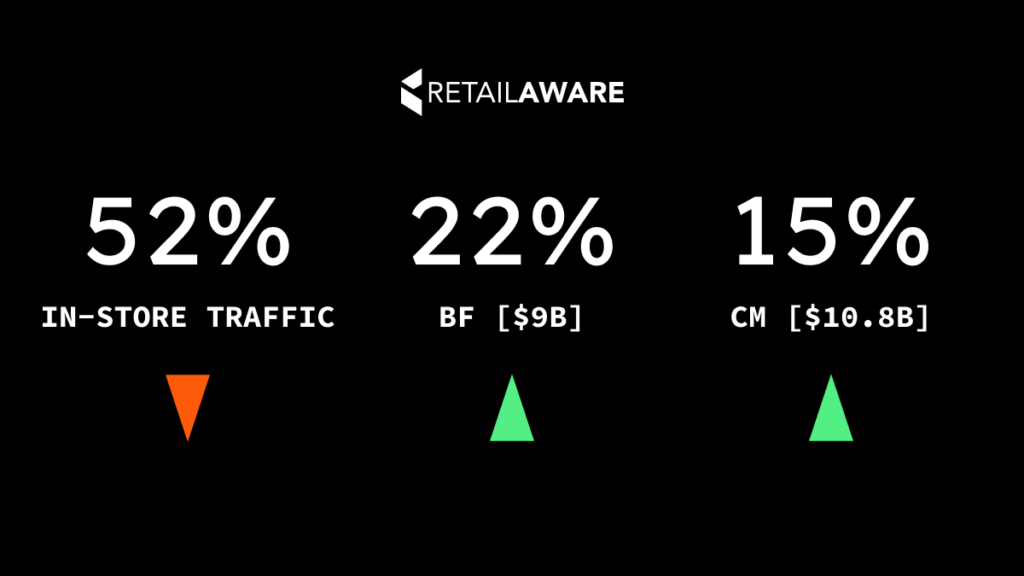

- In-store retail traffic on Black Friday was down 52% Black Friday ecomm sales were up 22%

Cyber Monday sales were up 15%

SOURCE: https://twitter.com/retailware

Forbes

- Forbes reported that Cyber Monday had a 15.1% increase over last year with $10.8 billion for the day. According to Adobe, the total season-to date holiday spending, including Cyber Monday, is over the $100 billion threshold. This milestone is usually not reached until mid-December. This was written on December 2.

- $106.5 billion: season-to-date online spending (up 27.7% from last year)

- 30%: the growth of curbside pickup year-over-year on Cyber Monday. 23.9%: sales decline in brick and mortar retailers.

And Last but Not Least, Amazon

Amazon’s take is always as the true marketplace for small businesses – “Amazon customers also made Black Friday and Cyber Monday the best-ever for independent businesses selling on Amazon—nearly all of which are small and medium-sized businesses— with worldwide sales growing over 60% year-over-year.”

Sales topped $4.8 billion in worldwide sales from Black Friday through Cyber Monday, an increase of over 60% from last year.

Wall Street firm Truist Securities says Amazon is poised to capture 42 cents of every dollar spent during the holidays. Isn’t that the same as saying 42% of e-commerce dollars spent this holiday season will go to Amazon? Wow.

SOURCE: https://www.aboutamazon.com/news/retail/supporting-small-saving-big-and-shopping-early

The Bottom Line

The pandemic continues to accelerate the growth of e-commerce. While this has been at the expense of retail store sales, the acceleration of innovation, apps, and services are helping to replace the in-store retail experience with a hybrid model so that curb-side pickup, retail delivery, and pick up at counter types services can thrive. Despite the Covid-19 vaccine breakthroughs we’ve had recently, it’s unlikely that we’ll see e-commerce activity slowing down any time soon. In fact, as cases continue to rise across the US, it’s likely that online stores will see heavy last-minute holiday season gift-buying activity that win normal years would happen in store.